Dive into the realm of AI-Based Risk Assessment in Home Insurance, where cutting-edge technology meets the world of insurance. Discover how artificial intelligence revolutionizes risk assessment in the comfort of your home, providing insights and solutions previously unattainable.

Learn about the pivotal role AI plays in reshaping the landscape of home insurance and how it impacts both insurers and policyholders alike.

Overview of AI-Based Risk Assessment in Home Insurance

AI-based risk assessment in the context of home insurance refers to the use of artificial intelligence technologies to analyze and evaluate potential risks associated with insuring a residential property. By leveraging AI algorithms and data analytics, insurance companies can accurately assess the likelihood and severity of risks, enabling them to make informed decisions when underwriting policies.

How AI is Used to Assess Risks in the Home Insurance Industry

In the home insurance industry, AI is utilized to process vast amounts of data related to a property, its location, and historical claims. Machine learning algorithms can identify patterns and trends that traditional methods may overlook, helping insurers to predict and mitigate risks effectively.

By analyzing factors such as weather patterns, crime rates, and property characteristics, AI can provide a comprehensive risk assessment for each policyholder.

Benefits of Using AI for Risk Assessment in Home Insurance

One of the key benefits of using AI for risk assessment in home insurance is the ability to enhance accuracy and efficiency. AI algorithms can quickly evaluate multiple risk factors simultaneously, leading to more precise underwriting decisions and personalized pricing for policyholders.

Additionally, AI can streamline the claims process by automating data analysis and fraud detection, improving overall customer satisfaction.

Examples of AI Technologies Commonly Employed in this Process

- Machine Learning Algorithms: These algorithms can analyze historical data to identify risk patterns and make predictions about future claims.

- Natural Language Processing (NLP): NLP technology can extract valuable insights from unstructured data sources, such as customer feedback or property inspection reports.

- Computer Vision: By analyzing images and videos, computer vision technology can assess property conditions and potential hazards remotely.

- Predictive Analytics: AI-driven predictive models can forecast risks based on various variables, enabling insurers to proactively manage potential threats.

Data Collection for AI-Based Risk Assessment

AI-based risk assessment in home insurance relies on the collection of various types of data to accurately determine the potential risks associated with insuring a property. This data is crucial for AI algorithms to analyze and predict the likelihood of certain events occurring that could lead to insurance claims.

Type of Data Collected

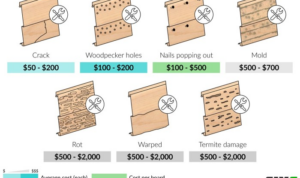

The data collected for AI-based risk assessment includes both traditional sources, such as property characteristics, location, and historical insurance claims, as well as non-traditional sources like weather patterns, crime rates, and proximity to fire stations or hospitals. This diverse range of data provides a comprehensive overview of the risk factors involved in insuring a home.

Data Sourcing, Processing, and Utilization

Data is sourced from various sources such as public records, IoT devices, and satellite imagery. Once collected, the data is processed using machine learning algorithms to identify patterns and correlations that can help predict potential risks. AI algorithms utilize this processed data to assess the overall risk associated with insuring a particular property and determine appropriate premiums.

Importance of Accurate and Diverse Data

Accurate and diverse data is essential for effective risk assessment in home insurance. By incorporating a wide range of data sources, AI algorithms can make more informed decisions and provide more accurate risk assessments. This ultimately leads to fairer premiums for policyholders and helps insurance companies better manage their risks.

Challenges in Data Collection

One of the main challenges related to data collection for AI-based risk assessment in home insurance is ensuring data accuracy and consistency. Inaccurate or incomplete data can lead to flawed assessments and inaccurate premium calculations. Additionally, ensuring data privacy and security is another challenge, as sensitive information needs to be protected throughout the data collection and processing stages.

AI Models and Algorithms for Risk Assessment

Artificial Intelligence (AI) plays a crucial role in revolutionizing risk assessment in home insurance. By leveraging advanced AI models and algorithms, insurance companies can accurately predict risks and tailor their policies accordingly.

Machine Learning Techniques in Risk Assessment

Machine learning techniques are commonly applied in AI-based risk assessment for home insurance. Algorithms such as decision trees, random forests, and support vector machines are used to analyze historical data and identify patterns that indicate potential risks. These models are trained on large datasets to improve accuracy and predictive capabilities.

Role of Neural Networks and Deep Learning

Neural networks and deep learning algorithms are increasingly being utilized in risk assessment for home insurance. These complex models can process vast amounts of data and extract intricate patterns to predict risks more accurately. By using deep learning techniques, insurance companies can enhance their risk assessment models and offer more personalized insurance policies to homeowners.

Natural Language Processing in Risk Assessment

Natural Language Processing (NLP) is another powerful tool used in AI-based risk assessment for home insurance. NLP algorithms can analyze text data from various sources, such as customer interactions, inspection reports, and claim forms, to extract valuable insights and assess risks effectively.

By incorporating NLP into their risk assessment process, insurance companies can improve decision-making and streamline operations.

Implementation and Integration of AI-Based Risk Assessment

Implementing AI-based risk assessment systems in home insurance companies involves a strategic approach to seamlessly integrate advanced technology into existing processes. This integration aims to enhance risk evaluation accuracy and efficiency.

Challenges and Limitations

- Resistance to change from traditional methods

- Data privacy and security concerns

- Lack of skilled personnel to manage AI systems

- Difficulty in interpreting AI-generated insights

During the integration of AI technologies for risk assessment in home insurance, companies may face several challenges and limitations:

Best Practices for Integration

- Provide thorough training to employees on AI systems

- Establish clear data governance policies

- Collaborate with AI experts for implementation

- Regularly evaluate and update AI models for accuracy

To ensure successful integration of AI-based risk assessment solutions in home insurance, companies can follow these best practices:

Complementing Traditional Risk Assessment

- Enhancing data analysis capabilities for more accurate risk prediction

- Automating repetitive tasks to improve operational efficiency

- Providing real-time insights for quick decision-making

- Adapting to evolving risk factors and trends more effectively

AI complements traditional risk assessment methods in the home insurance sector by:

Epilogue

In conclusion, AI-Based Risk Assessment in Home Insurance is not just a trend but a transformative force that promises a future of enhanced accuracy and efficiency. Embrace the possibilities that AI brings to the insurance industry, paving the way for a smarter and more secure tomorrow.

User Queries

How does AI impact the accuracy of risk assessment in home insurance?

AI enhances accuracy by analyzing vast amounts of data quickly and identifying patterns that traditional methods may miss.

What are some common challenges faced in implementing AI-based risk assessment systems?

Challenges include data privacy concerns, ensuring data quality, and the need for skilled professionals to manage AI systems.

Can AI-based risk assessment in home insurance completely replace traditional methods?

While AI offers significant advantages, traditional methods still play a role in providing comprehensive risk assessment.

How do neural networks contribute to risk assessment in home insurance?

Neural networks enable AI systems to learn complex patterns and relationships within data, improving risk assessment accuracy.