Delving into the realm of Insurance Discounts for Smart Water Systems, this exploration aims to shed light on how these systems can revolutionize insurance premiums and claims. From reducing water damage risks to unlocking potential savings, the landscape of smart water systems is brimming with opportunities for homeowners seeking to protect their properties.

Importance of Smart Water Systems in Insurance Discounts

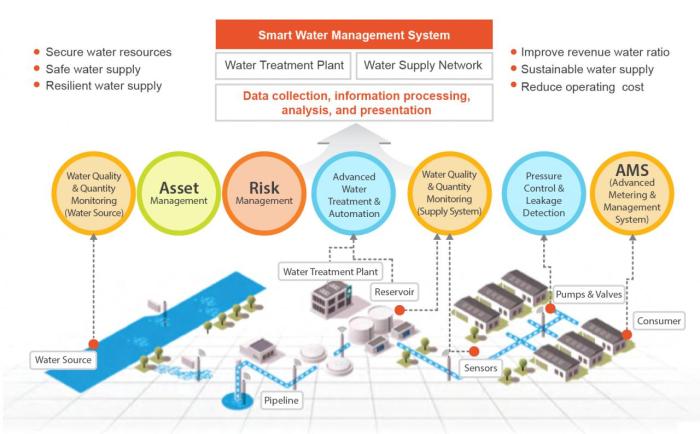

Smart water systems play a crucial role in reducing the risk of water damage in homes and businesses. By utilizing advanced technology, these systems can detect leaks, monitor water usage, and provide real-time alerts in case of any abnormalities. This proactive approach not only helps prevent water-related disasters but also minimizes the potential impact on properties and belongings.

Reduction in Insurance Claims and Premiums

- Smart water systems can significantly decrease the number of insurance claims related to water damage by addressing issues early on, before they escalate.

- Insurance companies often offer discounts on premiums for properties equipped with smart water systems, as they demonstrate a commitment to risk mitigation and property protection.

- By investing in smart water technology, homeowners and businesses can potentially lower their insurance costs in the long run, while also enjoying peace of mind knowing that their properties are safeguarded.

Specific Features Looked for by Insurance Companies

- Continuous monitoring capabilities that track water usage patterns and detect leaks or abnormalities in the system.

- Integration with smart home devices and platforms for seamless control and management of water systems remotely.

- Automatic shut-off valves that can stop water flow in case of emergencies, preventing further damage to the property.

- Data analytics and reporting features that provide insights into water usage trends and potential risks, allowing for proactive maintenance and risk mitigation.

Types of Insurance Discounts Available for Smart Water Systems

Installing smart water systems can lead to various insurance discounts offered by insurance companies. These discounts are aimed at encouraging homeowners to invest in technology that helps prevent water damage and minimize insurance claims. Let's explore the different types of insurance discounts available for smart water systems and compare their savings potential.

1. Leak Detection Discount

Insurance companies may offer a discount for installing smart water leak detection systems in your home. These systems can detect leaks and alert homeowners in real-time, helping to prevent extensive water damage. By offering a discount for these devices, insurance companies aim to reduce the risk of costly water damage claims.

2. Flood Sensor Discount

Another type of discount that insurance companies may offer is for installing flood sensors as part of a smart water system. Flood sensors can detect rising water levels and provide early warnings, allowing homeowners to take action before significant damage occurs.

This discount encourages homeowners to be proactive in protecting their homes from flooding.

3. Smart Irrigation System Discount

Some insurance companies may provide discounts for installing smart irrigation systems that help conserve water and prevent water waste. These systems use technology to monitor weather conditions and adjust watering schedules accordingly, reducing the risk of water-related damage to the property.

By promoting the use of smart irrigation systems, insurance companies aim to mitigate the risk of water-related claims.

4. Comprehensive Smart Home Discount

Insurance companies may offer a comprehensive discount for homeowners who have a full smart home system, including smart water systems. By integrating various smart devices into a centralized system, homeowners can better monitor and control their home environment, reducing the risk of potential damage.

This discount rewards homeowners for investing in smart technology to protect their homes.

Examples of Insurance Companies Offering Discounts:

- Allstate: Allstate offers discounts for homeowners who install smart water leak detection systems.

- State Farm: State Farm provides discounts for homeowners who have smart irrigation systems installed.

- Liberty Mutual: Liberty Mutual offers discounts for homeowners with comprehensive smart home systems that include smart water systems.

Installation Requirements for Qualifying for Insurance Discounts

Installing a smart water system is a great way for homeowners to protect their property from water damage and potentially qualify for insurance discounts. To ensure eligibility for these discounts, homeowners need to meet specific installation requirements and follow certain guidelines

Here is a checklist of requirements to consider:

Professional Installation

When it comes to maximizing insurance savings with a smart water system, professional installation plays a crucial role. Insurance companies often require systems to be installed by certified professionals to ensure proper functionality and reliability. Professional installation can also help homeowners avoid potential issues or malfunctions that could impact their insurance coverage.

Water Leak Detection

One of the key requirements for insurance discounts is the ability of the smart water system to detect water leaks effectively. Homeowners should ensure that the system is installed in a strategic location where it can monitor potential leak sources, such as plumbing fixtures, appliances, or water supply lines.

Proper placement and calibration of sensors are essential for accurate leak detection.

Remote Monitoring and Alerts

Insurance providers may also look for features like remote monitoring and alerts in smart water systems to qualify for discounts. Homeowners should connect the system to a reliable network and set up notifications for any detected leaks or abnormal water usage.

This proactive approach can help prevent extensive water damage and demonstrate the effectiveness of the system to insurance companies.

Regular Maintenance and Testing

To maintain eligibility for insurance discounts, homeowners should perform regular maintenance and testing of their smart water system. This includes checking sensors, batteries, and connectivity, as well as updating software or firmware as needed. By staying proactive in system maintenance, homeowners can ensure continued insurance coverage and potential discounts.

Compliance with Local Regulations

Lastly, it is essential for homeowners to comply with local regulations and building codes when installing a smart water system. Insurance companies may require proof of compliance to validate the eligibility for discounts. By following all installation guidelines and regulations, homeowners can confidently protect their property and secure insurance savings with a smart water system.

Maintenance and Monitoring Expectations for Insurance Discounts

Regular maintenance and monitoring of smart water systems are crucial for ensuring insurance coverage and receiving discounts. By keeping these systems in optimal condition, homeowners can prevent potential water damage and costly repairs, leading to lower insurance premiums and better coverage.

Importance of Regular Maintenance

- Regular maintenance helps identify any issues or malfunctions in the smart water system before they escalate into significant problems.

- It ensures that the system operates efficiently, reducing the risk of leaks or water damage.

- Insurance companies often require proof of regular maintenance to qualify for discounts, making it essential for homeowners to keep up with scheduled inspections and upkeep.

Tips for Effective Maintenance and Monitoring

- Follow the manufacturer's guidelines for maintenance tasks and schedules to ensure proper functioning of the smart water system.

- Check for leaks, drips, or unusual noises regularly to catch any issues early on.

- Monitor the system's app or dashboard for any alerts or anomalies that may indicate a problem.

- Consider investing in a professional maintenance service to conduct thorough inspections and maintenance tasks.

Consequences of Neglecting Maintenance

- Neglecting maintenance can lead to system malfunctions, leaks, or breakdowns, resulting in water damage and potential insurance claims.

- Insurance companies may deny coverage or reduce discounts if homeowners cannot provide proof of regular maintenance and monitoring.

- Costly repairs and replacements due to neglected maintenance can outweigh any potential insurance savings, ultimately costing homeowners more in the long run.

Conclusion

In conclusion, the path to securing insurance discounts through smart water systems is paved with insights and advantages that cannot be overlooked. By embracing the future of home protection, homeowners can not only safeguard their investments but also enjoy the peace of mind that comes with proactive risk management.

Questions and Answers

What specific features do insurance companies look for in smart water systems to offer discounts?

Insurance companies typically seek features like leak detection, automatic shut-off valves, and real-time monitoring capabilities to provide discounts.

How can homeowners ensure eligibility for insurance discounts with smart water systems?

Homeowners can ensure eligibility by meeting installation requirements, conducting regular maintenance, and keeping up with monitoring protocols set by insurance providers.

Are there consequences for neglecting maintenance of smart water systems in relation to insurance discounts?

Neglecting maintenance can lead to reduced coverage, higher premiums, and even the loss of insurance discounts associated with smart water systems.