Exploring the realm of Life Coverage Plans for Digital Nomads, this introduction delves into the importance of securing a safety net while navigating the digital nomad lifestyle. With a focus on tailored insurance solutions, this overview sets the stage for a deep dive into the world of life coverage for those living a mobile and dynamic existence.

As we uncover the intricacies of life coverage plans designed specifically for digital nomads, readers will gain valuable insights into the challenges and considerations unique to this community.

Definition of Life Coverage Plans for Digital Nomads

Life coverage plans, also known as life insurance, are financial products designed to provide a lump sum payment to beneficiaries in the event of the policyholder's death. These plans offer protection and financial security to the insured's loved ones during difficult times.Life coverage plans tailored for digital nomads cater specifically to the unique lifestyle and needs of individuals who work remotely and travel frequently.

These plans take into account the unpredictable nature of a digital nomad's lifestyle and offer coverage that is flexible and adaptable to their changing circumstances.

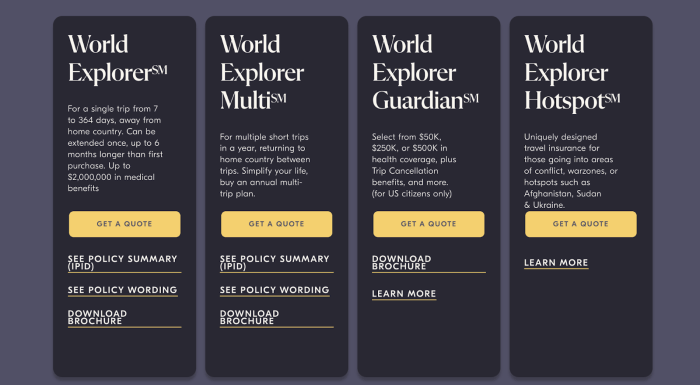

Insurance Companies Offering Tailored Life Coverage Plans for Digital Nomads

- SafetyWing: SafetyWing offers a comprehensive life coverage plan specifically designed for digital nomads, offering benefits such as global coverage, flexibility in coverage periods, and affordable premiums.

- World Nomads: World Nomads provides life coverage plans that cater to the needs of travelers and digital nomads, offering coverage for accidents, medical emergencies, and other unforeseen events that may occur while living a nomadic lifestyle.

- Nomad Insurance: Nomad Insurance offers customizable life coverage plans that can be tailored to suit the specific needs of digital nomads, providing peace of mind and financial security no matter where they are in the world.

Importance of Life Coverage for Digital Nomads

Life coverage is crucial for digital nomads due to the unique risks they face while living and working remotely. Unlike traditional workers, digital nomads often lack the safety nets provided by employers, such as health insurance, disability benefits, or life insurance policies.

This makes having a comprehensive life coverage plan essential to protect themselves and their loved ones in case of unforeseen circumstances.

Unique Risks Faced by Digital Nomads

- Digital nomads often travel to different countries, exposing themselves to unfamiliar healthcare systems and potential medical emergencies.

- They rely heavily on technology for work, making them vulnerable to cyber threats and data breaches that could jeopardize their livelihood.

- Living a nomadic lifestyle can lead to isolation and lack of support in times of need, making it essential to have a safety net in place.

Benefits of Having a Life Coverage Plan

- Peace of mind knowing that loved ones are financially protected in case of the digital nomad's untimely death.

- Financial security to cover funeral expenses, outstanding debts, or ongoing living costs for dependents.

- Access to medical and emergency assistance services, especially in foreign countries where healthcare may be limited or costly.

Statistics and Real-Life Stories

According to a survey by SafetyWing, a leading provider of digital nomad insurance, only 40% of digital nomads have life insurance coverage, leaving the majority at risk of financial instability in case of emergencies. Real-life stories of digital nomads experiencing unexpected accidents or illnesses highlight the importance of having a life coverage plan to mitigate the financial burden on themselves and their families.

Factors to Consider when Choosing Life Coverage Plans

When selecting a life coverage plan as a digital nomad, there are several key factors to consider to ensure you have the right protection in place for your unique lifestyle and work setup

Types of Coverage Options

- Term Life Insurance: Provides coverage for a specific period of time, offering a death benefit to beneficiaries if the insured passes away during the term.

- Permanent Life Insurance: Offers coverage for the lifetime of the insured, with a cash value component that can grow over time.

- Accidental Death and Dismemberment Insurance: Provides coverage specifically for accidents resulting in death or serious injury, offering financial protection in such scenarios.

Assessing Coverage Needs

- Evaluate your current financial obligations and future expenses to determine the amount of coverage needed to protect your loved ones.

- Consider your lifestyle as a digital nomad, including travel frequency and work-related risks, to assess the level of protection required.

- Review any existing coverage you may have through employer benefits or personal insurance policies to avoid duplication and ensure comprehensive protection.

Challenges Digital Nomads Face in Getting Life Coverage

Digital nomads face unique challenges when trying to secure life coverage due to their unconventional lifestyle and lack of a permanent residence. These challenges can make it difficult for them to access the same level of insurance coverage as traditional workers.

Obstacles in Obtaining Life Coverage

- Lack of Permanent Address: Insurance companies often require a permanent address for policyholders, which can be a challenge for digital nomads who are constantly on the move.

- Uncertain Income: Many insurance providers require proof of stable income to qualify for life coverage, but digital nomads may have fluctuating incomes due to the nature of their work.

- Healthcare Access: Digital nomads may face difficulties in accessing healthcare services in different countries, which can impact their ability to undergo medical examinations required for life insurance.

Solutions for Digital Nomads

- International Insurance Providers: Seek out insurance companies that cater to digital nomads and offer policies designed for individuals with a global lifestyle.

- Term Life Insurance: Consider opting for term life insurance policies that provide coverage for a specific period, which may be more flexible for digital nomads.

- Online Application Process: Look for insurance providers that offer online application processes and do not require a permanent address for policyholders.

Closing Notes

![The Digital Nomad: A Breakdown Of The Lifestyle [Infographic] - Venngage The Digital Nomad: A Breakdown Of The Lifestyle [Infographic] - Venngage](https://smart.viralsumsel.com/wp-content/uploads/2025/06/3-1024x1024-1.png)

In conclusion, Life Coverage Plans for Digital Nomads serve as a vital tool in safeguarding against unforeseen circumstances and providing a sense of security in an ever-changing landscape. By understanding the nuances of coverage options and the importance of securing a plan tailored to their lifestyle, digital nomads can embark on their journeys with confidence and peace of mind.

FAQ Section

What are the key factors to consider when choosing a life coverage plan as a digital nomad?

Factors to consider include coverage flexibility for travel, coverage for remote work setups, and international coverage options.

How does the nomadic lifestyle impact the ability to obtain life coverage?

The transient nature of a nomadic lifestyle can make it challenging to establish a permanent address, a requirement for traditional life coverage applications. However, there are alternative solutions available for digital nomads.

Why is life coverage essential for digital nomads?

Life coverage is crucial for digital nomads due to the unpredictable nature of their lifestyle, ensuring financial protection for themselves and their loved ones in case of any unforeseen events.