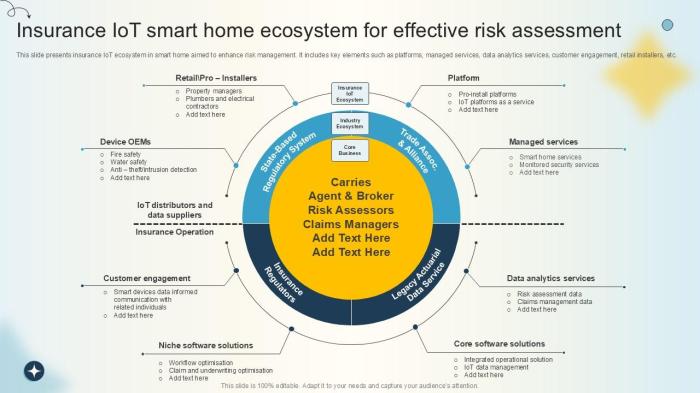

Diving into the realm of Comprehensive Insurance for IoT-Enabled Homes, this introduction aims to captivate readers with a detailed yet engaging overview of the topic.

The following paragraphs will delve into the intricacies of IoT technology and the significance of comprehensive insurance in protecting smart homes.

Overview of IoT-Enabled Homes

IoT-enabled homes are residences equipped with smart devices and technology that are interconnected through the Internet of Things (IoT). These devices can communicate with each other and be remotely controlled, offering homeowners increased convenience, security, and energy efficiency.

Examples of IoT Devices in Smart Homes

- Smart Thermostats: Devices that can adjust the temperature of your home based on your preferences and schedule, helping to save energy.

- Smart Security Cameras: Cameras that provide live video feeds and alerts to your smartphone, allowing you to monitor your home from anywhere.

- Smart Lighting: Lights that can be controlled remotely or automated to turn on and off based on your presence or schedule.

- Smart Locks: Locks that can be unlocked via smartphone or programmed with unique access codes for different users.

Benefits of IoT Technology in Enhancing Home Security and Convenience

- Enhanced Security: IoT devices can provide real-time alerts and monitoring, allowing homeowners to react quickly to potential security threats.

- Convenience: Remote control and automation features make it easier to manage various aspects of your home, such as temperature, lighting, and security, from anywhere.

- Energy Efficiency: IoT devices can help optimize energy usage by adjusting settings based on your habits and preferences, leading to potential cost savings.

Importance of Comprehensive Insurance

In the increasingly connected world of IoT-enabled homes, the importance of comprehensive insurance cannot be overstated. With a myriad of risks associated with smart devices and data security, having the right insurance coverage is crucial to protect homeowners.

Risks Associated with IoT-Enabled Homes

- Privacy breaches: Hackers can gain access to personal data stored on IoT devices, compromising the privacy of homeowners.

- Device malfunctions: Smart devices may experience technical issues or failures, leading to potential damage or accidents in the home.

- Cyber attacks: IoT devices are susceptible to cyber attacks, putting sensitive information and home security at risk.

How Comprehensive Insurance Mitigates Risks

- Financial protection: Comprehensive insurance provides coverage for damages or losses resulting from device malfunctions or cyber attacks.

- Liability coverage: In case of privacy breaches or accidents caused by IoT devices, comprehensive insurance can help cover legal expenses and liability claims.

- Data loss recovery: Comprehensive insurance may include coverage for data recovery and restoration in the event of data breaches or loss.

Coverage Provided by Comprehensive Insurance

- Property damage: Comprehensive insurance can cover repairs or replacements for smart devices damaged due to covered risks.

- Cyber liability: Protection against financial losses resulting from cyber attacks on IoT devices and data breaches.

- Data breach response: Assistance with managing and resolving data breaches, including notification costs and identity theft protection.

Factors to Consider When Choosing Insurance

When selecting comprehensive insurance for IoT-enabled homes, homeowners should carefully consider several key factors to ensure they are adequately protected. It is crucial to compare different insurance policies available for IoT devices and customize coverage based on the specific devices in the home.

Types of IoT Devices Covered

It is essential to determine which types of IoT devices are covered under the insurance policy. Some policies may only cover specific devices, such as smart thermostats or security cameras, while others may offer more comprehensive coverage for a wide range of IoT devices.

- Identify all IoT devices in your home and ensure they are included in the policy.

- Check if the policy covers both owned and rented IoT devices.

- Consider the age and condition of the devices to ensure they are eligible for coverage.

Coverage Limits and Exclusions

Homeowners should carefully review the coverage limits and exclusions of the insurance policy to understand what is and isn't covered. It is important to be aware of any limitations on coverage for specific IoT devices or scenarios.

Review the policy for any exclusions related to cybersecurity breaches or unauthorized access to IoT devices.

- Check if there are any coverage limits for individual devices or categories of devices.

- Understand the process for filing a claim related to IoT devices and any deductibles that may apply.

- Consider adding additional coverage or endorsements for high-value IoT devices.

Premium Costs and Discounts

In addition to coverage details, homeowners should consider the premium costs of the insurance policy and any available discounts. Comparing quotes from different insurers can help determine the most cost-effective option for comprehensive coverage.

- Ask about discounts for bundling IoT device insurance with other policies, such as homeowners or renters insurance.

- Consider the impact of deductible amounts on the overall cost of coverage.

- Explore options for adjusting coverage limits or adding riders to tailor the policy to your specific needs.

Data Privacy and Security

Ensuring data privacy and security in IoT-enabled homes is crucial in protecting personal information and preventing cyber threats.

Comprehensive Insurance Protection

- Comprehensive insurance for IoT-enabled homes can provide coverage in the event of a data breach or cyber attack, offering financial support for recovery and minimizing potential losses.

- Insurance policies may include coverage for legal expenses, data recovery costs, and compensation for affected individuals in case of a security breach.

Security Measures for Coverage

- Insurance companies may require homeowners to implement security measures such as encryption protocols, regular software updates, and strong password protection to qualify for coverage.

- Installing firewalls, antivirus software, and intrusion detection systems are examples of security measures that insurance companies may encourage or mandate for policyholders.

- Regular security audits and risk assessments may also be necessary to maintain insurance coverage and ensure adequate protection against cyber threats.

Outcome Summary

In conclusion, Comprehensive Insurance for IoT-Enabled Homes plays a crucial role in safeguarding against potential risks and ensuring peace of mind for homeowners in this digital age.

FAQs

What risks are associated with IoT-enabled homes?

Risks include data breaches, cyber attacks, and privacy concerns due to interconnected devices.

How does comprehensive insurance mitigate these risks?

Comprehensive insurance provides coverage for potential damages or losses caused by cyber threats or data breaches in IoT-enabled homes.

What factors should homeowners consider when choosing insurance for IoT-enabled homes?

Key factors include coverage for specific IoT devices, policy customization options, and the extent of protection against cyber risks.

How can comprehensive insurance protect against data breaches and cyber threats?

Comprehensive insurance offers financial coverage for losses resulting from data breaches, as well as assistance in dealing with cybersecurity incidents.

What security measures might insurance companies require for coverage in IoT-enabled homes?

Insurance companies may require the implementation of strong encryption protocols, regular software updates, and network monitoring to enhance security.