Insurance Savings with Smart Tech Integration sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Smart technology has transformed the landscape of insurance savings, providing individuals with innovative ways to lower insurance costs through the integration of cutting-edge devices.

This article delves into the realm of smart tech integration in the insurance sector, exploring the myriad benefits, types of devices, implementation strategies, and future trends that shape the future of insurance savings.

Benefits of Smart Tech Integration in Insurance Savings

Smart technology integration in insurance can lead to various benefits, including reducing insurance costs and improving overall risk management. By utilizing smart devices and systems, insurance companies can gather more accurate data on policyholders' behaviors and make more informed decisions on premiums.

Examples of Specific Smart Devices for Savings

- Smart home security systems: Installing smart security cameras, sensors, and alarms can reduce the risk of break-ins or damage, leading to lower home insurance premiums.

- Telematics devices for vehicles: Using telematics devices to monitor driving habits can result in personalized auto insurance rates based on actual driving behavior, potentially lowering costs for safer drivers.

- Water leak detectors: Smart water leak detectors can help prevent costly water damage by alerting homeowners of leaks early, potentially reducing the likelihood of claims and lowering insurance premiums.

Impact of Smart Tech on Insurance Premiums

Smart technology can significantly impact insurance premiums by incentivizing policyholders to adopt safer behaviors and practices. With the data collected from smart devices, insurance companies can offer discounts and rewards for proactive risk management, ultimately leading to cost savings for policyholders.

Types of Smart Tech Devices for Insurance Savings

Smart tech devices play a crucial role in helping individuals save on insurance costs by promoting safer behaviors and reducing risks. Let's explore some common types of smart devices that are utilized for insurance discounts.

Telematics Devices

Telematics devices, such as plug-in dongles or mobile apps, monitor driving behaviors like speed, braking, and acceleration. Insurers use this data to assess risk accurately, rewarding safe drivers with lower premiums. By promoting safer driving habits, telematics devices can lead to significant savings on auto insurance.

Smart Home Security Systems

Smart home security systems, equipped with sensors, cameras, and alarms, reduce the risk of burglary or property damage. Insurance companies often offer discounts to homeowners who invest in these systems, as they mitigate the likelihood of filing claims due to theft or vandalism.

By enhancing home security, smart tech devices can result in lower home insurance premiums.

Water Leak Detection Devices

Water leak detection devices alert homeowners about leaks or floods, preventing extensive water damage and costly repairs. Insurance providers may offer discounts to policyholders who install these devices, as they help mitigate the risk of water-related claims. By proactively identifying and addressing leaks, these devices contribute to savings on property insurance.

Health and Fitness Trackers

Health and fitness trackers monitor users' physical activity, heart rate, and sleep patterns. Some health insurance companies offer incentives or discounts to policyholders who meet fitness goals tracked by these devices. By promoting a healthy lifestyle, these trackers not only improve overall well-being but also lead to potential savings on health insurance premiums.

Implementation Strategies for Smart Tech Integration

Smart tech devices offer numerous benefits when integrated into homes, including enhanced security, energy efficiency, and cost savings on insurance premiums. Here are some strategies for effectively implementing smart tech integration:

1. Installation and Placement

- Ensure proper installation of smart devices such as security cameras, smart thermostats, and leak detectors in key areas of your home.

- Place sensors strategically to cover vulnerable entry points and areas prone to water damage or fire risks.

2. Automation and Monitoring

- Set up automation routines for smart devices to optimize energy usage, detect anomalies, and respond to emergencies promptly.

- Regularly monitor the performance of smart tech systems to ensure they are functioning correctly and providing the intended benefits.

3. Data Security and Privacy

- Implement robust cybersecurity measures to protect sensitive data collected by smart devices from potential breaches or unauthorized access.

- Review privacy settings and permissions to control the sharing of personal information with third parties and maintain confidentiality.

4. Integration with Insurance Policies

- Explore insurance providers that offer discounts or incentives for integrating smart tech devices into your home security and monitoring systems.

- Review your insurance policy to understand the specific requirements and recommendations for smart tech integration to maximize potential savings.

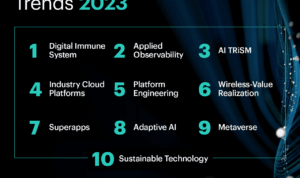

Future Trends in Smart Tech Integration for Insurance Savings

The future of smart tech integration in insurance savings is poised to revolutionize the industry, offering new opportunities for cost optimization and risk management. As emerging technologies continue to evolve, insurers are expected to leverage these advancements to enhance their offerings and provide more tailored solutions to customers.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are expected to play a significant role in the future of insurance savings. These technologies can analyze vast amounts of data in real-time, enabling insurers to better assess risk, detect fraud, and personalize premiums for policyholders.

By implementing AI-driven solutions, insurance companies can streamline their operations and make more informed decisions, ultimately leading to cost savings for both the insurer and the insured.

Internet of Things (IoT)

The Internet of Things (IoT) is another trend that is set to transform insurance savings in the future. IoT devices, such as smart sensors and wearables, can collect valuable data on policyholders' behavior and lifestyle, allowing insurers to offer usage-based insurance and incentivize customers for adopting healthier habits.

This data-driven approach not only reduces risks but also promotes preventive measures, ultimately lowering insurance costs in the long run.

Cybersecurity and Data Protection

With the increasing digitization of insurance processes, cybersecurity and data protection will become critical factors in ensuring cost-effective insurance savings. Insurers will need to invest in advanced cybersecurity measures to safeguard sensitive customer information and mitigate cyber threats. By prioritizing cybersecurity, insurance companies can build trust with their customers and avoid costly data breaches that could impact their bottom line.

Enhanced Customer Experience

In the future, smart tech integration will focus on enhancing the overall customer experience in insurance savings. From personalized policy recommendations to seamless claims processing, insurers will leverage technology to provide a more convenient and efficient service to policyholders. By prioritizing customer satisfaction and loyalty, insurance companies can improve retention rates and reduce acquisition costs, ultimately leading to long-term savings for both parties.

Final Conclusion

As we conclude this exploration of Insurance Savings with Smart Tech Integration, it becomes evident that the fusion of technology and insurance has opened up a world of possibilities for cost savings and enhanced security. By embracing smart tech devices, individuals can not only protect their homes but also enjoy reduced insurance premiums.

The future looks promising as emerging technologies continue to revolutionize the insurance landscape, offering new avenues for optimizing costs and improving overall coverage.

Essential FAQs

How can smart technology help in reducing insurance costs?

Smart technology enables insurers to monitor risks more effectively, leading to personalized pricing and lower premiums for policyholders.

What are some examples of smart devices that can lead to insurance savings?

Smart thermostats, water leak detectors, and security cameras are a few examples of devices that can help individuals reduce insurance costs.

How can individuals integrate smart tech devices into their homes for insurance benefits?

Individuals can connect smart devices to a central hub for remote monitoring, ensuring that their homes are secure and reducing the risk of insurance claims.

What are some future trends in smart tech integration for insurance savings?

Emerging technologies such as blockchain and AI are expected to play a significant role in streamlining insurance processes and further lowering costs for policyholders.